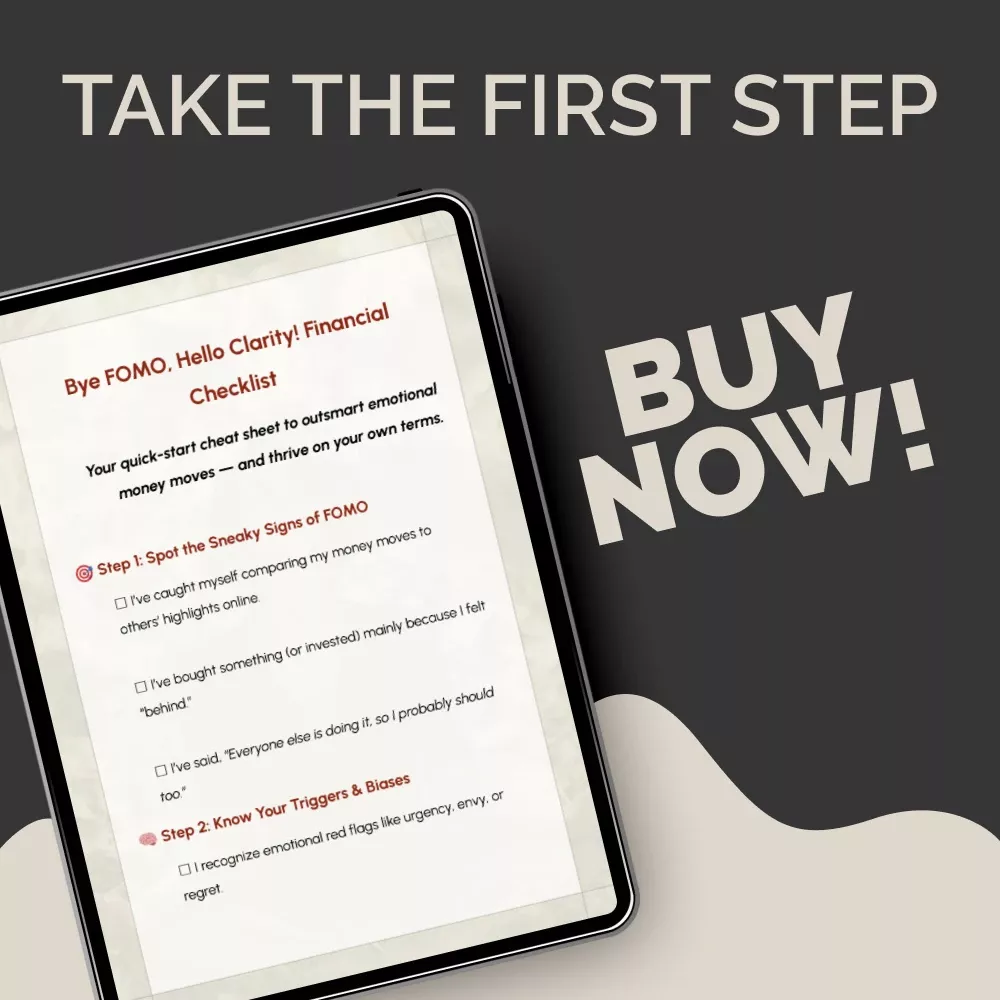

Break Free from FOMO and Take Back Your Financial Power

Say goodbye to emotional money decisions and hello to confidence, calm, and clarity. Bye FOMO, Hello Clarity! Financial Checklist is your quick-start cheat sheet designed to help you recognize and outsmart the subtle ways fomo behavioral finance influences your money moves. Whether you’re a chronic comparer, an impulse investor, or just tired of second-guessing your financial choices, this printable digital checklist helps you create space for smarter, values-based decisions—without the stress or guilt.

What’s Inside

- Simple, guided steps to identify emotional money triggers and reclaim focus.

- Behavioral insights and reflection prompts grounded in fomo behavioral finance.

- Practical tools to reset your habits and rebuild confidence in your financial decisions.

This checklist takes you on a focused journey—from spotting FOMO to creating your own calm, intentional money strategy. Each section reveals the “aha” moments you didn’t know you needed—until now.

Key Benefits

- Spot emotional patterns that lead to overspending or regretful investing.

- Learn how fomo behavioral finance impacts your daily money choices—and how to take back control.

- Use evidence-based tools to replace anxiety with intentional, value-driven action.

- Get a printable, easy-to-follow format you can revisit whenever FOMO strikes.

- Perfect for professionals, creators, investors, or anyone ready to build a calm, confident relationship with money.

Why It’s Different

Unlike typical budgeting templates or mindset worksheets, this checklist combines behavioral science with real-life practicality. It’s short, actionable, and empowering—no jargon, no fluff. You’ll leave with tangible steps to understand your emotions, align your goals, and make decisions that truly fit your life.

Start Your Financial Reset Today

Stop letting FOMO steer your financial journey. Download Bye FOMO, Hello Clarity! Financial Checklist now and take the first confident step toward financial peace, focus, and freedom.

4 GREAT REASONS TO BUY FROM US:

- Over 37,000 happy customers across the US

- Real people on our support team ready to help

- The finest materials and stunning design — all our products are developed with an obsessive dedication to quality, durability, and functionality

- We use the most secure online ordering systems on the market, and are constantly improving our software to make sure we offer the highest possible security

BUY WITH CONFIDENCE

Our mission is to make your shopping experience as safe and enjoyable as possible. Have questions? Feel free to contact our award-winning customer care team for advice on everything from product specifications to order tracking.

- Money back guarantee: Something not quite right? If you’re not totally satisfied with your purchase, you can return it within 15 days for a full refund

- Risk-Free Purchase: We utilize industry-standard Secure Sockets Layer (SSL) technology to allow for the encryption of all the sensitive information, so you can be sure your details are completely safe with us

- Trustworthy payment method: We partner with the most popular online payment solutions that guarantee enhanced security and fast transaction processing

Man, I gotta tell ya, this tool is a total game-changer! It's like stumbling upon a secret weapon that gives you the upper hand in your battle against overspending. You know those moments when you're just about to splurge on something unnecessary and then suddenly realize what's happening? Yeah, it helps with that. It's like having an emotional map right there in your pocket, showing you all the hidden patterns and triggers leading to reckless spending. It doesn't just stop at identifying these patterns though; it goes one step further by helping you understand them better so they don't control your wallet anymore. Imagine having a super-smart money therapist who’s always ready for a session whenever needed. They're not sitting across from you in some stuffy office – nah mate, they’re right there with you wherever life takes ya. In line at the grocery store? Check. Browsing through online sales late at night? Double-check! This tool has got your back 24/7! And let me tell ya another thing: this isn’t some generic advice-giving robot either - no way Jose! It’s personalized to fit YOU and YOUR habits which makes it feel less like using an app and more like chatting with a friend who really gets where you’re coming from financially. So yeah, if anyone out there is struggling to get their spending under control or if emotions tend to drive their financial decisions (we've all been there), give this little lifesaver of a tool a whirl! Trust me on this one guys - once you start seeing those patterns clearly laid out before your eyes... well let’s just say things will never be quite the same again!

Such clarity, such control! This checklist has given me the confidence to make smarter financial decisions every day.

No more regretful investing for me thanks to this digital download. I've learned so much about how FOMO impacts my money choices and now I can take back control!

recommend

I never thought a printable PDF could be so powerful. Helps keep track of spending habits and makes you think twice before making any hasty purchases.

This behavioral finance tool has been invaluable for understanding my spending habits better - it's an eye-opener!

😊

The value-driven approach really resonated with me. No more mindless spending or investing out of fear or pressure.

This financial checklist isn’t just any regular budgeting tool; it's like getting your hands on some secret wisdom that changes everything you thought you knew about handling money! For starters, learning about fomo behavioral finance was enlightening; realizing how much of our spending is driven by fear rather than need really puts things into perspective. But what sets this product apart is its focus on replacing these negative emotions with rational decision-making based on personal values and long-term goals – now that’s empowering! And let's not forget its practicality: being able to print it out means you can keep it handy and refer back to it whenever you feel the need. This tool has been a game-changer for me, helping me build a more intentional and confident relationship with my finances.

As an investor, learning about fomo behavioral finance was enlightening and extremely useful

Impressive

A must-have tool for anyone wanting to develop a calm relationship with their finances 👌🏼

this checklist is a great way to keep track of your spending habits...it's easy to use and very helpful

👍👍👍

I've been on the lookout for a tool that could help me improve my financial habits and boy, did I hit the jackpot with this one. The digital download was easy to access and it's printable too which is perfect because I love having a physical copy of things. It helped me identify emotional patterns leading to overspending or regretful investing - something I didn't even realize I was doing! Now, instead of being driven by anxiety or FOMO, my decisions are intentional and value-based. What's more, it’s not just a one-time thing – whenever FOMO strikes again, all I have to do is revisit the checklist. This has truly been instrumental in building a calm and confident relationship with money.

Finally saying bye-bye to FOMO and hello to clarity when it comes to my finances - what a relief!

love it

Solid

This digital download is worth every penny! It's an investment that pays off by helping you make smarter financial decisions.

A practical guide for everyone who wants a confident relationship with their money – best purchase I've made in ages!

ok

As someone who has always struggled with managing finances effectively, this behavioral finance tool came as an absolute godsend for me! It provided clear insights into how fear can impact daily money choices - from spending habits to investment decisions. The evidence-based tools were particularly helpful as they replaced my usual anxiety with purposeful action grounded in logic rather than emotion. Moreover, its user-friendly format made revisiting it every time FOMO kicked in so much easier! In no time at all, I found myself making smarter decisions about where my money goes without feeling overwhelmed or stressed out about it.

satisfactory