Take Control of Your Student Loans with Confidence

If student loans feel overwhelming, you’re not alone. This Student Loan Management Checklist is your step-by-step digital guide to organizing, understanding, and taking action on your debt. Instead of guessing or feeling lost, you’ll have a clear, practical roadmap filled with real options, legal strategies, and smart financial steps. Whether you’re exploring how to get out of paying student loans through forgiveness or simply want lower payments and less stress, this checklist helps you move forward with confidence and clarity.

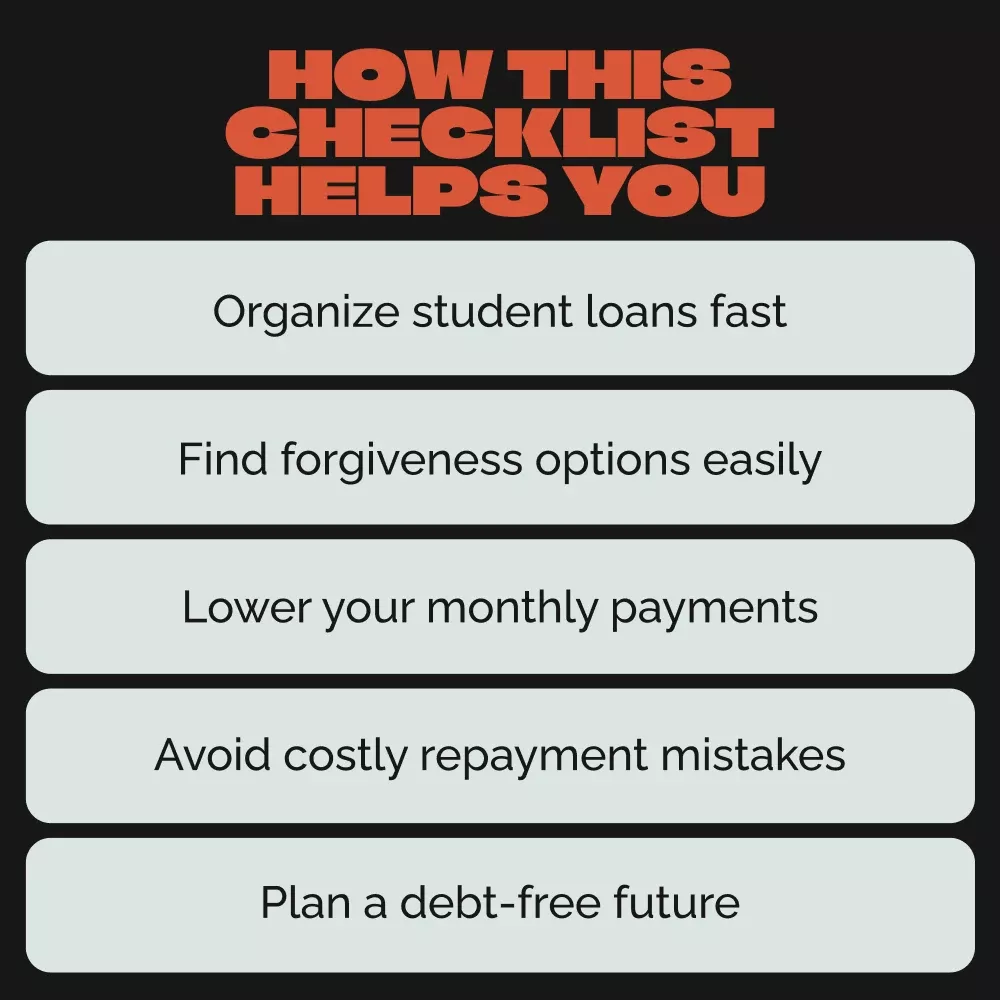

What Are the Product’s Main Features?

The Student Loan Management Checklist includes structured sections based on real student loan scenarios, from first-time loan organization to advanced options like forgiveness qualifications and understanding how to get out of paying student loans legally through hardship or government programs. It’s designed with checkboxes, prompts, and action steps so you’re never left wondering what to do next.

Who Is This For?

This checklist is perfect for students, graduates, or professionals dealing with federal or private student loans. If you feel confused about repayment plans, curious about forgiveness, or searching for how to get out of paying student loans the right way, this resource is built for you.

What Makes It Different From Other Resources?

Unlike generic blog posts or overwhelming legal articles, this checklist is organized into clear, actionable steps. It combines expert research with easy language, realistic scripts, and visual structure so you can actually use it. Many resources just talk about how to get out of paying student loans — this one gives you a safe, structured plan to explore your options legally and responsibly.

Practical Benefits for You

- Reduce confusion and stress around student loan management

- Save time with organized, step-by-step action plans

- Avoid common mistakes that lead to higher debt

- Increase your chances of qualifying for forgiveness programs

- Gain confidence when speaking with loan servicers or financial professionals

- Build smarter financial habits to prevent future debt

Download and Take Action Today

You don’t have to stay stuck or overwhelmed. This Student Loan Management Checklist gives you a clear plan, real answers, and proven steps you can start using immediately. If you’re serious about learning how to get out of paying student loans through legal, ethical options and smarter strategies, this is the tool you need.

Download your copy today and start taking control of your financial future with confidence.

4 GREAT REASONS TO BUY FROM US:

- Over 37,000 happy customers across the US

- Real people on our support team ready to help

- The finest materials and stunning design — all our products are developed with an obsessive dedication to quality, durability, and functionality

- We use the most secure online ordering systems on the market, and are constantly improving our software to make sure we offer the highest possible security

BUY WITH CONFIDENCE

Our mission is to make your shopping experience as safe and enjoyable as possible. Have questions? Feel free to contact our award-winning customer care team for advice on everything from product specifications to order tracking.

- Money back guarantee: Something not quite right? If you’re not totally satisfied with your purchase, you can return it within 15 days for a full refund

- Risk-Free Purchase: We utilize industry-standard Secure Sockets Layer (SSL) technology to allow for the encryption of all the sensitive information, so you can be sure your details are completely safe with us

- Trustworthy payment method: We partner with the most popular online payment solutions that guarantee enhanced security and fast transaction processing

I feel more confident now when talking to loan servicers👍👍

I'm so glad I found this guide, it's been incredibly helpful in navigating the complex world of student loans. It's saving me time and helping me avoid common mistakes that lead to higher debt.

Informative

i've learned how to qualify for forgiveness programs and build smarter financial habits for the future

Thanks to these legal strategies, I see light at the end of the tunnel!

The step-by-step action plans are easy to follow and really save time - no more endless searching on what steps should be taken next.

lifesaver

wasn't sure how to get out from under my massive student loans until i got this checklist. it's given me confidence when dealing with financial professionals.

The advice is practical, organized and truly beneficial.

i love that this guide helps prevent future debt by teaching you smarter financial habits while also giving you ways out of your current situation!

These legal strategies have not only helped manage my existing debts but also taught me valuable lessons on preventing future ones